Insights from the OECD Panel on Certification and Labelling

What’s a Rich Text element?

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

H1

H2

H3

H4

H5

H6

Static and dynamic content editing

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content,

add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Vsadsadsdasdasdasdasdoila!

- A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

- t to that field

- t to that field

-

How to customize formatting for each rich text

How to customize formatting for each rich text

How to customize formatting for each rich text

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

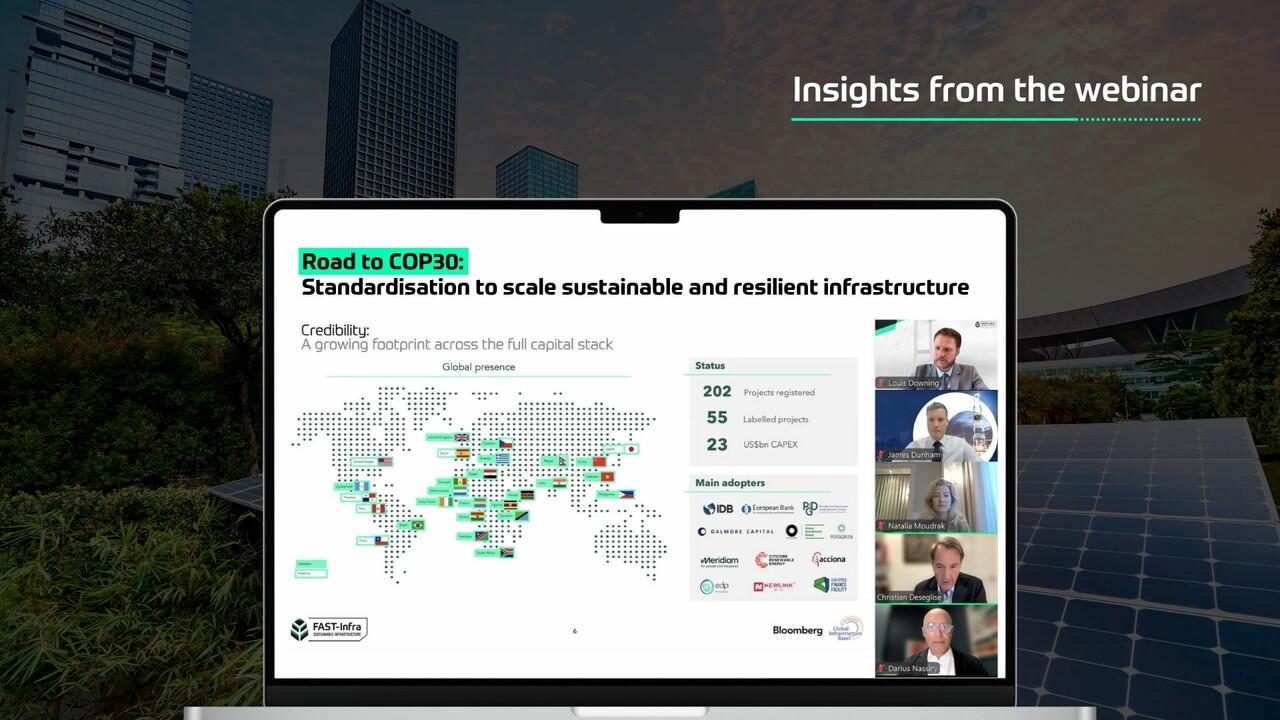

On 9 April 2024, OECD held a panel discussion named Certification and Labelling of Sustainable Infrastructure Projects. The event paved the way for labelling infrastructure projects for investors and stakeholders, allowing them to identify sustainable projects. During the event, dynamic discussions and exchanges took place between Francois Bergere (CEO, FAST-Infra Group), Liz Rich (Head of Strategy and Corporate Development, Bloomberg LP), Edwin Lau (Head, Blue Dot Network Secretariat), Amine Idriss Adoum (Senior Director, African Union Development Agency-NEPAD), Francesca Maria Cerchia (Global Head Climate Change and Sustainability Solutions, SGS), with the discussion moderated by Matthew Jordan-Tank (Director, Sustainable Infrastructure Policy & Project Preparation at EBRD). Among the topics discussed, both the labels have initiated conversation, aiming at working closely, and continuing discussions in the world of sustainable infrastructure projects stood out as a symbol of progress. This signals a new era of cooperation and harmonisation of standards in the realm of sustainable infrastructure.

This blog aims to capture the important points and moments shared during the discussions through five key insights.

Here are the key insights from the discussion:

- Labelling and certification are tools to attract investment in sustainable infrastructure and turn it into an asset class.

The maturing market for sustainable infrastructure investments is characterised by standardised criteria, clear labelling, and a broad base of interested investors. The creation of the labelling and certification systems like the FAST-Infra Label and the Blue Dot Network (BDN) is based on the collective experience of a wide array of stakeholders, including governments, NGOs, and private investors, this points to a concerted effort to make sustainable infrastructure more attractive and accessible to a diverse range of investors.

- Systems based on multiple Standards and Frameworks facilitate interoperability and collaboration which ensures complementarity.

Interoperability and collaboration among labels and standards are vital to streamlining the investment process. Building on existing multiple standards and frameworks, the FAST-Infra Label ensures a common language in terms of sustainable infrastructure, this reduces the confusion coming from different labelling systems, thereby simplifying the investment process for sustainable infrastructure projects. This trend towards collaboration and interoperability of standards is crucial for attracting more investments into sustainable infrastructure by providing clear, standardised information and definitions to investors.

- Importance of Data and Transparency in enabling investors to make informed decisions.

The emphasis on the need for actionable, cross-comparable datasets across different geographies and asset classes underscores the growing importance of data in sustainable infrastructure investment. Bloomberg L.P. is currently developing the Data Repository of the FAST-Infra Label, achieving data transparency and data quality which is playing a critical role in enabling investors to make informed decisions. This points towards a future where data-driven decision-making becomes a cornerstone of sustainable infrastructure financing, driven by the availability of granular, reliable data.

- Focus on Community Benefits and Environmental Impact to ensure that projects have a social impact along with an environmental one.

The discussion underscored the importance of ensuring that infrastructure projects not only adhere to environmental standards but also deliver tangible benefits to local communities. This is enshrined in the ‘Environmental’ and ‘Social’ dimensions of the FAST-Infra Label and in the criteria used by Blue Dot Network (BDN), which includes "access to infrastructure" as a key measure of a project's value. This reflects a broader shift in the sustainable infrastructure paradigm towards projects that are environmentally sustainable and socially inclusive, aligning with global efforts to achieve the SDGs.

- Exploratory Collaboration Potential: FAST-Infra Label and Blue Dot Network (BDN).

The insights derived from the recent OECD event offer a compelling narrative of progress and collaboration in the pursuit of a sustainable future. As the complexities of global infrastructure investment progress, the first exploratory conversation between the FAST-Infra Label and the Blue Dot Network (BDN) emerges as a shining example of collective action and standardisation. By simplifying the certification process and promoting interoperability among labels, this potential collaboration sets the stage for a more streamlined and transparent investment landscape, one that resonates with the growing demand for sustainable solutions. As stakeholders look ahead, they can continue to leverage these insights and alliances to drive meaningful change, ensuring that sustainable infrastructure not only becomes an asset class but also a catalyst for positive social and environmental impact worldwide.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.webp)

.webp)