The Role of Sustainable Finance in Tackling Climate Change

What’s a Rich Text element?

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

H1

H2

H3

H4

H5

H6

Static and dynamic content editing

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content,

add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Vsadsadsdasdasdasdasdoila!

- A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

- t to that field

- t to that field

-

How to customize formatting for each rich text

How to customize formatting for each rich text

How to customize formatting for each rich text

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

As the world heads toward COP30, nearly a decade after the Paris Agreement, 2024 marked a sobering milestone — the first full year in which the 1.5°C global warming threshold was breached.

In 2023 alone, global economic losses from weather-related disasters exceeded $380 billion (AON, 2024). At the same time, communities in low-income and climate-vulnerable regions are being pushed further to the brink. In 2023, approximately 26.4 million people were displaced by climate-related hazards, primarily floods, storms, and droughts. Addressing this crisis will require more than policies and pledges. It will require transforming how we finance the future.

According to the OECD, the world needs to invest an estimated USD 6 trillion annually until 2040 to meet the Sustainable Development Goals (SDGs). Much of this must go toward sustainable infrastructure — the systems that power our cities, move our people, and protect our environment.

A Transition That Demands Trillions

Sustainable finance refers to financial flows — public, private, or blended — that are aligned with resilience and risk reduction goals. It powers the shift from fossil fuels to clean energy, from reactive disaster recovery to proactive resilience building, from inequality to inclusion.

Today, developing countries require around $1.1 trillion for climate finance. But they’re only getting $333 billion, mostly from sustainable debt instruments like green bonds, and public sources contribute more than half.

Climate finance breakdown

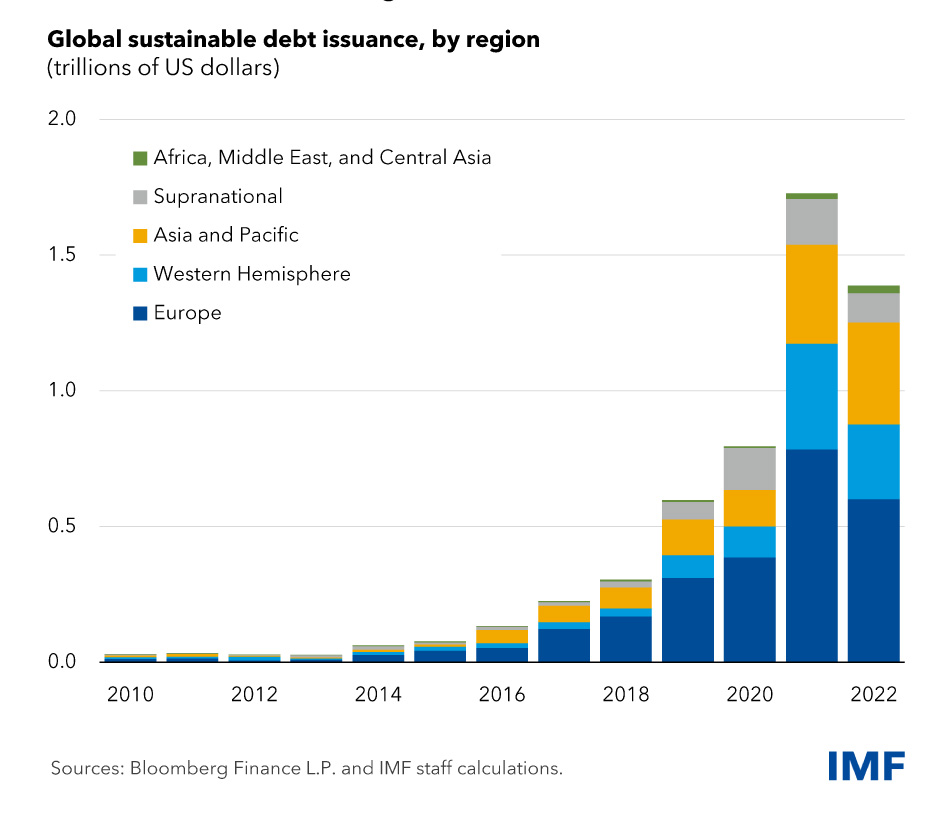

Asia accounts for a quarter of the world's sustainable debt issuance, which includes green bonds.

Sustainable finance tools are helping bridge the gap:

- Green bonds raised over $620 billion globally in 2023, up from $557 billion in 2022.

- Sustainability-linked loans are emerging as a preferred model for companies tying financial performance to impact.

- Blended finance is unlocking private capital by using public funds to de-risk projects in EMDEs.

As Barbara Buchner, Global Managing Director at Climate Policy Initiative, notes:

“The rise of green bonds, impact funds, and other sustainable finance tools is creating new pathways for private capital to support climate-aligned infrastructure. But for me, success really starts with scale—specifically, a significant increase in private investment in sustainable infrastructure. We need to go far beyond where we are today. That means bringing in actors who haven’t traditionally been involved.”

Tools and Trends Driving Investment in Resilient Infrastructure

According to Barbara Buchner, Global Managing Director at Climate Policy Initiative (CPI) these six trends are shaping investment in resilient infrastructure:

1. Sustainable Urban Development

As stated in the IFC analysis (Climate Investment Opportunities in Cities), more than half the world’s population now lives in cities, private investment in sustainable buildings and urban infrastructure is on the rise—an essential step toward ensuring our cities are resilient for the long-term.

2. Clean Energy Systems

One of the most significant shifts in climate finance has been the surge in private capital toward energy infrastructure, particularly grid systems. Declining technology costs—especially in renewables and storage—have lowered entry barriers and given private investors greater confidence to engage in the clean energy transition.

3. Greener Transportation

The transport sector is seeing a boost in electric vehicles (EVs) and their associated infrastructure. As adoption grows, so does investor interest in electrification and low-carbon mobility.

4. Innovative Financial Instruments

The rise of green bonds, impact funds, and other sustainable finance tools is creating new pathways for private capital to support climate-aligned infrastructure.

5. Blended Finance and Public-Private Partnerships

To de-risk investments and bridge financing gaps, blended finance mechanisms and PPP models are gaining traction. These collaborative tools help attract new pools of capital to invest.

6. Technology and Digital Innovation

New technologies—like climate-smart grids—are opening up fresh investment frontiers, making climate finance more data-driven, efficient and scalable.

The Path Forward

With close to 17% of all external financing classified as sustainable finance in Europe, it is no longer a niche. When structured thoughtfully, it delivers returns, mitigates risk, and unlocks inclusive growth. But scaling it will require cross-sector collaboration, clear policy signals, and strong accountability mechanisms.

“Sustainable infrastructure is not a cost, but an opportunity — one that delivers environmental, economic, and social returns.”

The challenge is enormous. But so is the opportunity. The world’s financial systems must evolve — not just to manage climate-related risk, but to actively shape a more resilient, equitable future.

How can the FAST-Infra Label help scale private investments toward sustainable infrastructure?

To scale private investment in sustainable infrastructure, there is the need to start strengthening and leveraging domestic markets. That’s where people understand what needs to happen on the ground.

But for that to work, there is also the need for better standards, better metrics, and—just as importantly—the capacity to actually use them effectively. Stronger risk management, and integrating both risks and benefits into the investment process from the very beginning, are essential.

That kind of consistency is exactly what’s needed to unlock larger flows of capital and build trust across the investment landscape. With a tool such as the FAST‑Infra Label, it would be possible to establish the kind of clear, credible framework that helps private investors engage with greater confidence—and at scale.

A key shift in the market is the demand for standardized frameworks that evaluate the sustainability and resilience of infrastructure projects. Initiatives like the FAST-Infra Label help:

- investors distinguish sustainable assets from greenwashing

- increase transparency and comparability across regions

- provide developers with a framework for building resilient and sustainable infrastructure

- support banks in their investment decision and

- allocate funds to sustainable assets

Building sustainable and resilient infrastructure demands more than capital—it requires confidence, clarity, and coordination. As climate challenges grow more complex, tools like the FAST-Infra Label can help ensure that finance flows where it’s needed most, and that every dollar invested contributes to a resilient and equitable future.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.webp)

.webp)