From Risk to Resilience: How PCRAM, PIDG and the FAST‑Infra Label Turn Climate Uncertainty into Investable Opportunity

What’s a Rich Text element?

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

H1

H2

H3

H4

H5

H6

Static and dynamic content editing

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content,

add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Vsadsadsdasdasdasdasdoila!

- A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

- t to that field

- t to that field

-

How to customize formatting for each rich text

How to customize formatting for each rich text

How to customize formatting for each rich text

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

In fast‑growing, climate‑exposed markets, the difference between a stranded asset and a high‑performing one often comes down to how well physical climate risk is understood, priced, and managed across the infrastructure lifecycle. A recent marine transport case on Lake Victoria shows how theInstitutional Investors Group on Climate Change (IIGCC),Private Infrastructure Development Group (PIDG), and the FAST‑Infra Label together create a clear, finance‑grade path from climate analysis to sustainable asset certification, improving bankability and insurability in infrastructure finance and accelerating sustainable impact investment.

A first‑of‑its‑kind marine transport service on Lake Victoria

PIDG backed a pioneering scheduled roll‑on/roll‑off (RoRo) service carrying 21 fully laden trucks - carrying up to 1,000 tonnes of cargo per crossing – between Port Bell, Uganda and Mwanza, Tanzania. By shifting freight off congested roads to the lake, the project significantly cuts journey times from 3-4 days to just 18 hours, reduces logistics costs, improves safety, and drives low‑carbon trade across East Africa. Building the vessel also required establishing local shipbuilding capacity—creating skilled jobs and enabling a pipeline of future maritime projects. From an investor’s perspective, it is a textbook example of green infrastructure financing aligned with impact investing in infrastructure assets and responsible investment policy.

But Lake Victoria’s water levels fluctuate greatly. Without targeted adaptation, periods of extreme high or low levels can disrupt operations at quays and ramps, compromising service reliability and revenue. That is where IIGCC’s Physical Climate Risk Appraisal Methodology (PCRAM), comes in.

Learn more about the PCRAM 2.0 case study.

PCRAM: Turning climate science into investment decisions

“PCRAM moves investors from risk towards opportunity,” explains Anne Chataigné, Adaptation & Resilience Lead at IIGCC. “Its singularity is integrating physical climate risks and opportunities into cash‑flow forecasts, and then sharing risk and reward across the investment value chain—investors, insurers and lenders working from the same playbook.”

In Lake Victoria, the project team used PCRAM’s four practical steps to make climate‑related risk mitigation decision‑relevant:

- Identify climate dependencies. Lake Victoria’s water levels drive operability - at the extreme risking flooding or grounding. System factors like two hydropower operations were also mapped—critical for sustainability risk management.

- Assess financial materiality. PCRAM quantifies how downtime impacts revenues and IRR, linking climate science to infrastructure investment strategy and financial materiality of sustainability risks.

- Define adaptation options. Low-cost measures—extra dredging, longer and removable ramps—secured operability across most scenarios. Clear adaptive pathways and triggers ensure resilience to uncertainty.

- Share risk and reward. The process fosters dialogue with lenders and insurers on how resilience supports bankability and insurability, enabling insurance solutions for resilient infrastructure and risk-sharing frameworks.

“Working with IIGCC and Oxford scientists gave us standardized and objective guidelines to incorporate climate resilience into the investment decision,” says Marco Serena, Chief Sustainable Impact Officer at PIDG. “We could quantify how small design tweaks reduce downtime and de‑risk sustainable infrastructure investments while keeping the internal rate of return (IRR) attractive.”

The investor and manager view: Adaptation that pays

PIDG invests across sub‑Saharan Africa and South/Southeast Asia—geographies with the largest infrastructure access gaps and some of the highest climate vulnerabilities. For PIDG, the Lake Victoria analysis yielded three enduring lessons for sustainable infrastructure fund managers and asset owners:

- Quantify the value of adaptation. Cost-effective measures in adaptation and climate mitigation scenarios can protect availability and revenues, support asset managers in sustainable infrastructure fundraising, and improve compliance for insurability of sustainable infrastructure projects.

- Plan for uncertainty. Climate variability is expected to intensify significantly over the next 20–25 years. Defining monitoring metrics and pre‑modelled contingency capex ensures resilience even under extreme scenarios, reinforcing portfolio sustainability risk assessment and climate risk management for asset managers.

- Think system‑wide and nature‑positive. Shoreline permeability and vegetation affect flood risk; hydropower dispatch shapes lake levels. PIDG is funding ecosystem studies to guide nature‑based solutions, an approach consistent with positive contribution to SDGs in infrastructure and infrastructure sustainability frameworks.

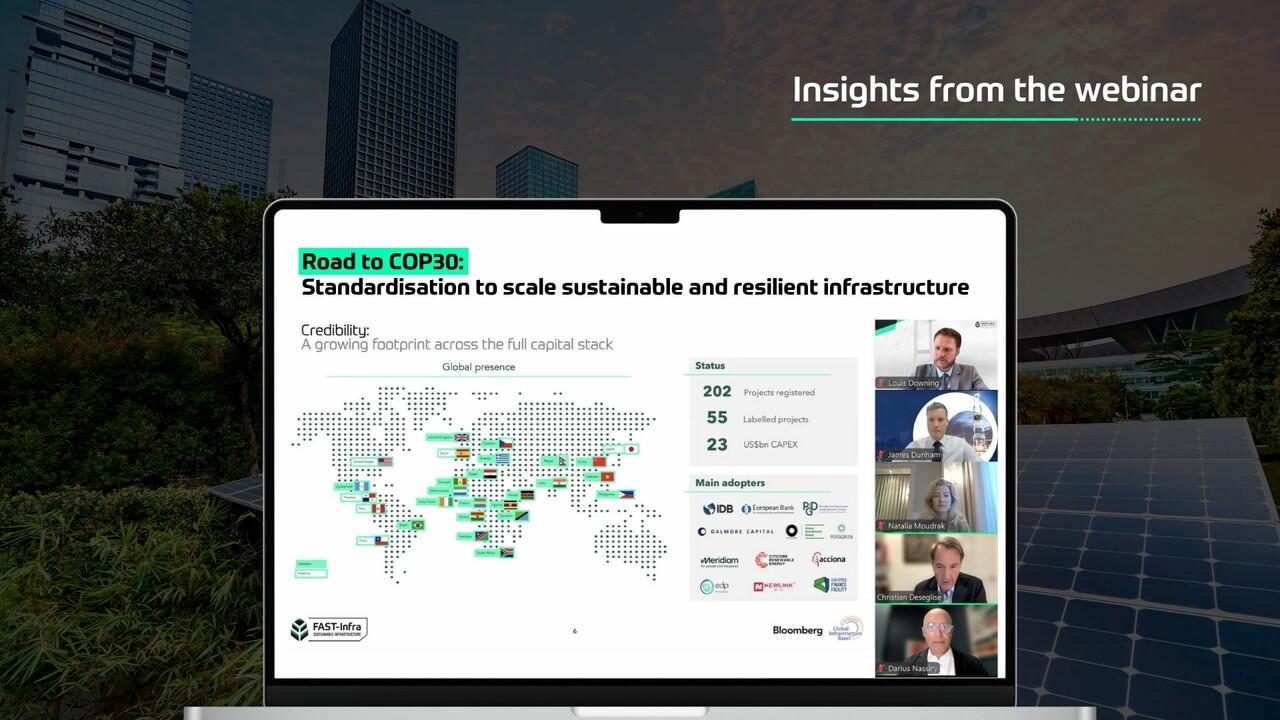

Where labelling adds value: From evidence to market signal

If PCRAM supplies the evidence, the FAST‑Infra Label supplies the signal. “PCRAM provides the robustness of methodology; FAST‑Infra amplifies it,” notes Chataigné. After completing the appraisal, theLake Victoria asset earned the FAST‑Infra Self-Assessment Label in early 2024, with particular recognition for climate adaptation and resilience, climate mitigation, biodiversity, and gender equality (including training for women in maritime roles). For sponsors and managers, that recognition translates into:

- Standardization and comparability of infrastructure performance through the FAST-Infra Label, enabling infrastructure fund sustainability benchmarking, infrastructure fund sustainability certification, and sustainability governance for portfolio companies—all increasingly relevant for LP sustainability commitments in infrastructure and responsible investment for LPs.

- A credible pathway to EU taxonomy alignment, more consistent sustainability reporting for investors and GPs against reporting requirements—supporting sustainability integration in infrastructure portfolios funds.

- A stronger case with insurers through clearer insurable infrastructure design standards, resilience standards for insurance underwriting, and ultimately better infrastructure insurance affordability and availability.

For asset‑level exits and refinancing, the Label helps to streamline infrastructure risk transparency standards and sustainable infrastructure due diligence—exactly what secondary buyers want to see in green infrastructure investment strategies and impact measurement.

Learn more about the FAST-Infra Label Framework

What similar projects can do next

- Start early. Embed a PCRAM‑style assessment at the project feasibility stage to shape design before costs lock in—especially for energy transition infrastructure, social infrastructure investment, ports, waterways and renewable energy storage solutions, or even carbon capture in infrastructure where climate dependencies and operability thresholds matter.

- Marry hard and soft measures. Combine engineering tweaks with nature‑positive actions and clear operational triggers to keep assets resilient—this is pragmatic climate resilience in infrastructure, not an add‑on.

- Signal quality. Use the FAST‑Infra Label for asset managers and the FAST‑Infra Label for infrastructure funds to demonstrate infrastructure investment sustainability compliance, taxonomy alignment for infrastructure funds, and disciplined asset acquisition sustainability processes.

As Serena puts it: “When you’re debating budget lines for resilience, remember: the moment to build for the future is before the investment is locked. The Lake Victoria case shows that targeted adaptation can protect returns, users, and ecosystems.”

Stronger together than the sum of their parts

PCRAM made climate science actionable; PIDG, as investor‑developer, implemented low‑regret measures and adaptive pathways; the FAST‑Infra Label turned that work into a market‑recognised sustainable asset certification. In Anne Chataigné’s words, “PCRAM and FAST‑Infra together are stronger than the sum of their parts.” For managers and owners navigating the low‑carbon economy transition, this is a replicable blueprint for sustainability frameworks for infrastructure investors that reduces risk, improves bankability and insurability, and mobilizes private capital at scale.

Start the FAST-Infra Label Application process today!

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.webp)

.webp)