.jpg)

Building Resilient and Sustainable Infrastructure: An Interview with Peter Hall

What’s a Rich Text element?

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

H1

H2

H3

H4

H5

H6

Static and dynamic content editing

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content,

add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Vsadsadsdasdasdasdasdoila!

- A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

- t to that field

- t to that field

-

How to customize formatting for each rich text

How to customize formatting for each rich text

How to customize formatting for each rich text

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

In a rapidly changing world, sustainable infrastructure is no longer a choice but a necessity. In a conversation with Peter Hall, Advisor for Climate Loop - Ambition Loop, Resilience Committee to the TURF fund and formally the Managing Director - Resonance Impact Advisory, we discussed emerging trends, challenges, and financing solutions like the FAST-Infra Label that are reshaping the sector.

Peter Hall brings a wealth of expertise in sustainable infrastructure and climate adaptation. As part of the Ambition Loop’s Climate Capital Mobilization Accelerator, he focuses on financing sustainable infrastructure in the Global South. In addition, Peter was formally the Managing Director at Resonance Impact Advisory, where he led private sector engagement, and as Vice President for Sustainable Infrastructure at WSP and Wood Group, driving climate adaptation across their global projects. In this interview, Peter offers invaluable insights into the future of resilient infrastructure and the critical steps needed to build a sustainable urban future.

How can we effectively integrate climate adaptation and resilience into infrastructure projects?

The urgency for climate adaptation is growing, but the availability of funding remains a major challenge. We need to mobilize $2.4 trillion by 2030, yet financing for adaptation projects remains slow, particularly in the Global South, where over four billion people face extreme climate risks in a 1.5°C world.

To ensure that available funding reaches the projects that need it most, we must establish better mechanisms to connect funders with investable opportunities. While many projects exist, they often lack the pre-feasibility work needed to attract capital. On the design side, developers must prioritize creating infrastructure that is not only bankable but also resilient enough to withstand future climate shocks. One promising solution is leveraging local resources and expertise to enhance both long-term sustainability and economic viability.

What are the challenges hindering private investment in sustainable infrastructure?

One of the biggest challenges private sector investors face is demonstrating a clear return on investment. Many companies are motivated by sustainability goals, meeting SDG targets, but they still need financial justification for their investments.

Additionally, sustainable infrastructure projects often carry a high perception of risk due to uncertainties around who will build, operate, and maintain the infrastructure over time. This is particularly true in developing regions where governance structures and regulatory frameworks may be less robust.

To overcome these hurdles, we need better risk mitigation strategies, improved governance structures, and financial innovations that make infrastructure projects more investable. If we can demonstrate long-term value and stability, we can encourage more private capital to flow into sustainable infrastructure.

Can you share an example of a successful project from your work that effectively addressed multiple challenges, such as climate adaptation, social equity, and economic empowerment?

One of the most impactful projects I worked on was a coastal resilience initiative in Africa, which was part of the Urban Resilience Fund, a $500 million effort I helped develop.

This project integrated climate adaptation into infrastructure design. Some of the key elements included:

- Constructing new roadways designed to mitigate the impacts of coastal flooding and sea level rise.

- Relocating fishing villages from high-risk zones to safer, more sustainable locations.

- Implementing heat management solutions to reduce urban heat stress.

- Focusing on women's economic empowerment, ensuring that new infrastructure provided better economic opportunities for local women.

Local governments recognized the broader economic and social benefits of this project and provided additional funding. This demonstrated that resilient infrastructure not only reduces risks but also contributes to economic growth and improved quality of life.

This multi-stakeholder approach, combining rigorous planning, governance, and diverse funding sources, provides a replicable model for other vulnerable regions looking to build climate-resilient infrastructure.

What key strategies can project developers implement during the design stage to enhance climate adaptation and resilience, ensuring their projects address both current vulnerabilities and future climate challenges?

Developers should focus on three core strategies to improve the adaptation and resiliency aspects of their projects:

- Integrate Future Climate Data:

Developers must analyze potential future climate impacts and incorporate this data into the design process. By preparing for future climate shocks, projects can be built to withstand or adapt to changing conditions without incurring prohibitive costs. - Invest in Upfront Pre-Feasibility Studies:

Thorough early-stage planning is essential to mitigate risk. Investing in pre-feasibility studies allows developers to assess the technical, operational, and financial viability of a project before significant capital is deployed. This proactive approach will reduce risk and also enhance investor confidence by creating a more robust investment case. - Build a Diverse Capital Ecosystem:

Successful projects often leverage a mix of funding sources. Peter stresses the importance of creating a “capital stack” that includes support from foundations, insurance companies, banks, and even carbon market participants. By combining investments from a diverse range of financial players, projects become de-risked and more attractive to private capital.

What role does the FAST-Infra Label play in enabling project developers to assess and enhance the sustainability and resilience performance of infrastructure projects?

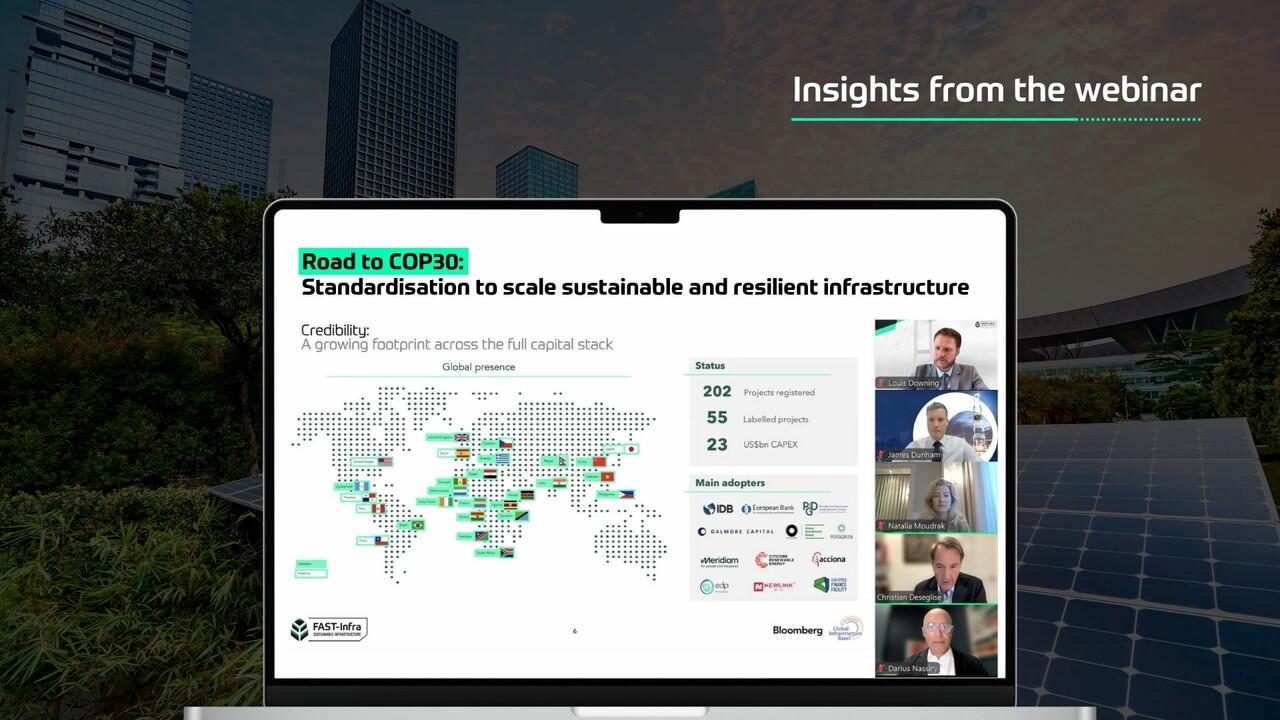

The FAST-Infra Label is one of the most innovative labels in sustainable infrastructure. The Label establishes baseline criteria across environmental, social, and resilience dimensions, ensuring that projects meet essential benchmarks before accessing financing.

Some of the key benefits of the FAST-Infra Label include:

- Applicability across multiple asset classes, from roads and water plants to renewable energy projects.

- A structured evaluation process that helps asset owners improve their project design and sustainability performance.

- Enhanced investor confidence, as the Label provides a standardized framework for evaluating sustainability and resilience.

I've been involved with FAST-Infra Label from the early stages, serving on its Executive Advisory Committee and working with the Emerging Markets Working Group to drive capital toward infrastructure projects in the Global South. The Label’s partnership with Bloomberg will also help improve visibility and access to financing by connecting asset owners with investors at the right stage of project development.

What’s next for sustainable infrastructure?

The future of sustainable infrastructure depends on collaboration between developers and investors. As climate risks intensify, we must scale up financing solutions to build projects that are both resilient and sustainable.

Innovative labels like the FAST-Infra Label, along with advancements in risk mitigation and financial structuring, will play a key role in accelerating investment in sustainable infrastructure. By integrating climate resilience into project design, leveraging new financing models, and fostering global partnerships, we can build more resilient and sustainable infrastructure.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.webp)

.webp)